Understanding the Difference Between Refinancing and Debt Consolidation

Refinancing and debt consolidation are two common approaches that individuals may consider to manage their finance burdens. While these strategies aim to alleviate debt related stress, it’s important to understand the key differences between them to make an informed decision.

Refinancing: A fresh start on your loans

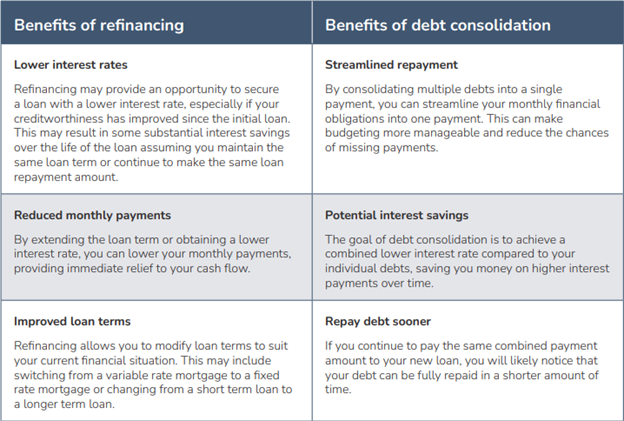

Refinancing is the process of replacing an existing loan with a new one that typically comes with different terms, interest rates and repayment periods. By refinancing a mortgage, borrowers seek to take advantage of more favourable terms or interest rates to reduce their monthly payments, lower interest costs or change the loan structure to better suit their financial goals.

When we help our clients to refinance their mortgage(s) we research and source a range of finance options from different lenders or sometimes the same lender who issued their original mortgage(s) with the goal of achieving more favourable conditions.

The new loan is used to repay the balance of the existing loan, effectively closing the previous loan. Depending on the borrower’s goal and circumstances, refinancing may not be just about reducing the overall debt burden, it may also be focused on restructuring the terms of the loan.

Debt Consolidation: Streamlining multiple debts

Debt consolidation involves combining multiple debts into a single loan. It is commonly used to manage credit card debt or other unsecured loans. The goal is to streamline debt repayment and potentially secure more favourable terms such as a lower interest rate or a longer repayment period.

With debt consolidation, as your finance specialist, we find a lender who will cover the outstanding balances of your various debts. Once approved, the new loan is used to pay off the individual debts leaving you with only one loan to manage. The new lender may request you to cancel your existing credit cards or reduce the limit to remove the potential of accumulating debt repeating itself.

Key differences between refinancing and debt consolidation

While both refinancing and debt consolidation involve obtaining a new loan to manage existing debts, there are key differences to consider:

1. Scope of debt

Refinancing typically focuses on a single loan, such as a mortgage or personal loan, while debt consolidation encompasses multiple debts and often unsecured debts like credit cards or personal loans.

2. Restructuring vs consolidation

Refinancing aims to restructure the terms of an existing loan, whereas debt consolidation combines multiple debts into one loan or payment plan.

3. Interest considerations

When it comes to interest, the implications of refinancing and debt consolidation can differ:

Refinancing

When refinancing a loan, the goal is often to secure a lower interest rate than what was initially obtained. By refinancing at a lower rate, you can potentially save money on interest payments over the life of the loan. However, it’s important to consider any associated fees or closing costs that may be involved in the refinancing process as these can impact the overall cost effectiveness of the new loan.Debt consolidation

With debt consolidation, the interest rate on the consolidated loan will depend on various factors including your creditworthiness and the terms negotiated with the new lender. While it is possible to obtain a lower interest rate through consolidation, it is not guaranteed. Some debt consolidation options may even result in higher interest rates, especially if your credit score has declined since the original debts were incurred. It is crucial to carefully evaluate the interest rate and terms offered for the consolidated loan to ensure it provides a meaningful benefit in terms of interest savings.

Potential drawbacks and considerations

Extended repayment period

Both refinancing and debt consolidation may extend the repayment period compared to the original loans. While this can lead to lower monthly payments, it can also result in paying more interest over the long term. You should consider the impact of an extended repayment period on your overall financial goals and the total cost of the loan.

Risk of accumulating new debt

When consolidating multiple debts, there is a risk that you may continue to accumulate new debt while repaying the consolidated loan. This can result in a higher overall debt burden and financial strain. It is essential to address the root causes of debt and adopt responsible spending habits to avoid falling into a cycle of debt accumulation.

Impact on credit score

Both refinancing and debt consolidation can have an impact on your credit score. When refinancing, the credit inquiry and closing of the previous loan may cause a temporary dip in your credit score. Similarly, debt consolidation may also initially impact your credit score. However, if you successfully manage the consolidated loan and make timely payments, it can have a positive impact on your credit score over time.

Each approach has its own benefits and considerations regarding interest rates, repayment periods and potential impact on credit scores. It is crucial for you to carefully evaluate your financial situation, goals and the terms offered by lenders to determine the option most suitable for your specific needs.

And that’s why we are here to help and guide you through these finance options and decisions.

If you'd like help with assessing your personal and financial situation, as well as comparing the loans in the market to see if you're truly getting the right deal for you, then call Bob Malpass now on 0431 862 136, email [email protected] or send us a message via our website for a quick response.

Thanks for reading

Bob

Disclaimer

The advice provided on this website is general advice only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. If any products are detailed on this website, you should obtain a Product Disclosure Statement relating to the products and consider its contents before making any decisions. Where quoted, past performance is not indicative of future performance.

Malpass Finance Pty Ltd disclaim all and any guarantees, undertakings and warranties, expressed or implied, and shall not be liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or consequential loss or damage) arising out of or in connection with any use or reliance on the information or advice on this site. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information on this website is no substitute for qualified financial advice.